Mortgage calculator with interest only period

Enter the number of years your mortgage will be amortized for. After that time period however it adjusts annually based on market trends until the loan is paid off.

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

You can also see the savings from prepaying your mortgage using 3 different methods.

. For example a 51 IO ARM would charge interest-only for the first 5 years of the loan then at that point the loan would convert into an amortizing loan where the remaining principal is paid off over the subsequent 25 remaining years of the loan. The payment rises because interest rates are rising and because. Building a Safety Buffer by Making Extra Payments.

For example a 5 interest rate on a 200000 mortgage balance would add 833 to the monthly payment. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years. Average for 2022 as of August 26 2022.

Historical mortgage rates chart. Rates and repayments are indicative only and subject to change. It is effectively like 2 loans in one.

Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years. Amortization A 30-year mortgage will repay at a. A mortgage calculator helps prospective home loan borrowers figure out what their monthly mortgage payment will be.

Chart represents weekly averages for a 30-year fixed-rate mortgage. Total years including the interest-only period Interest Rate the annual nominal interest rate or stated rate on the loan Interest Only for the period of time that the mortgage will be interest-only. The Vertex42 Interest-Only Loan Calculator is a very powerful spreadsheet based on our popular Loan Amortization ScheduleIt helps you calculate your interest only loan payment for a fixed-rate loan or mortgage and lets you specify the length of the interest-only IO period.

Fixed-rate 5-year interest-only mortgage--The monthly payment stays at 1035 for the first 5 years and then increases to 1261 in year 6 as you begin to pay down the principal. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. For a basic type of mortgage use this simple mortgage calculator or mortgage calculator with taxes and insurance.

A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan. 30-Year Fixed-Rate Mortgage Loan Amount. It is important to note that interest costs increase significantly if the amortization period is over 25 years.

51 interest-only ARM--The monthly payment stays at 960 for 5 years but increases to 1204 in year 6. You can also calculate the effect of including extra payments before and after the IO. An interest-only loan is simply a loan where the borrower is obligated to pay only the interest on the loan for a certain period of time whether that be for a portion of the loan period or the entire loan period with the obligation to pay back the principal of the loan at the end of loan period.

Private mortgage insurance rates are typically 05 to 10 of the value of the mortgage. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. The initial interest rates are normally 05 to 2 lower than FRM with the same loan term.

Initial inputs will be displayed on the left hand side of the calculator. Fixed vs variable interest rates. For ARMs interest rates are generally fixed for a period of time after which they will be periodically adjusted based on market indices.

The more you borrow the higher your payments keeping the same amortization period. Homeowners with an adjustable-rate mortgage can expect their mortgage payment to change too after the loans initial fixed period ends. As the balance is paid down through monthly payments the.

The results from this calculator are an approximate guide only and do not constitute specialist advice. For example if you have credit card debt at 15 percent it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate. With a variable interest rate mortgage the interest rate will change when the TD.

Further unlike many other debts mortgage debt can be deducted from income taxes for those who itemize their. Private mortgage insurance or PMI is a type of insurance typically required by the mortgage lender when the borrowers down payment on a home is less than 20 of the total cost of the home. A borrower also benefits from purchasing discount points by lowering their applied interest rate over time.

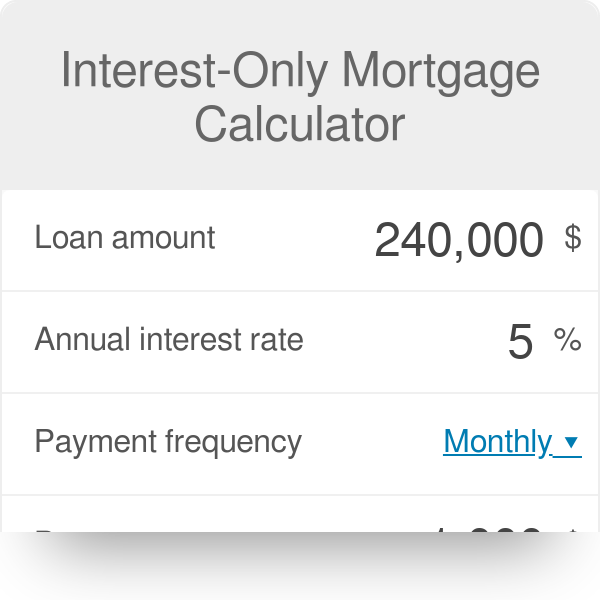

This handy calculator can help you determine what your savings and ultimate cost with an interest only mortgage verses a. An interest only loan for the introductory period. Using an interest-only mortgage payment calculator shows what your monthly mortgage payment would be by factoring in your interest-only loan term interest rate and loan amount.

Mortgage rates valid as of 31 Aug 2022 0919 am. Compare your potential savings to your other debts. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Check out the webs best free mortgage calculator to save money on your home loan today. Our calculator includes amoritization tables bi-weekly savings. This calculator applies to loans which have an interest-only period then for the remaining period of the loan both principal amount borrowed and interest are repaid.

The ability to pay interest-only and only on the amount you draw makes this option attractive for many borrowers. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. The calculator above calculates fixed rates only. HELOCs and home equity loans are typically approved in a 2 to 4 week period with the approval process rarely taking more than 6 weeks.

Though the interest rate typically drops only a fraction of a percentage per point this difference can be felt in each monthly payment as well as the total amount you eventually pay. Mortgage loan basics Basic concepts and legal regulation. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

With a fixed rate mortgage the interest rate and the payment you make will stay constant for the term of your mortgage offering stability. Mortgage interest rates are normally expressed in Annual. How to Calculate Payments.

Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. Use our free mortgage calculator to easily estimate your monthly payment.

Mortgage calculator - calculate payments see amortization and compare loans.

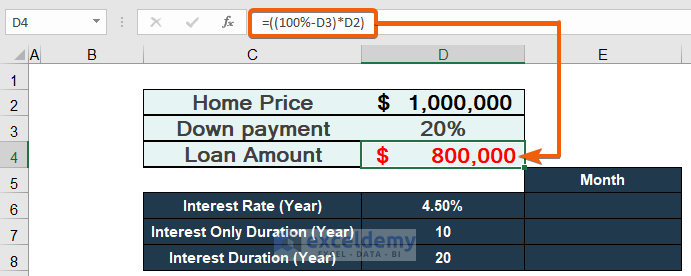

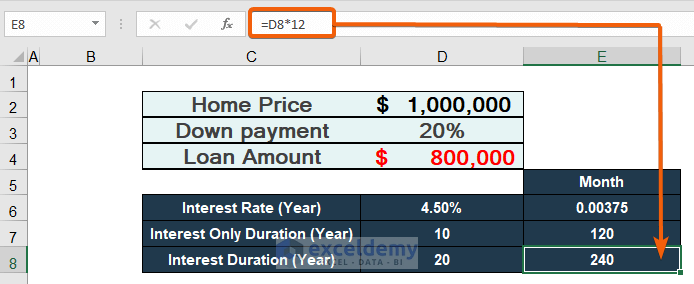

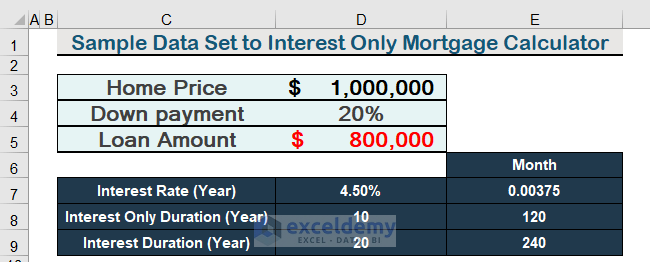

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Loans Mortgage Loan Calculator Mortgage Amortization Calculator

Interest Only Mortgage Calculator

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

15 Mortgage Loan Calculators For Wordpress Wp Solver Mortgage Loan Calculator Mortgage Loans Mortgage Calculator

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Interest Only Calculator

Mortgage Amortization Calculator Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Chart Amortization Schedule

Interest Only Mortgage Calculator

Is A Balloon Mortgage Really What You Want Loan Calculator Mortgage Loan Pay House Loan Payme Amortization Schedule Free Mortgage Calculator Mortgage Loans

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

Free Interest Only Loan Calculator For Excel

Interest Only Calculator

Use Excel To Create A Loan Amortization Schedule That Includes Optional Extra Payment Amortization Schedule Mortgage Amortization Calculator Schedule Templates

Interest Only Loan Calculator Free For Excel